Depreciable Asset Tax Return Japan . Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web for japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the japanese tax law (tax useful life). Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said.

from www.realestate-tokyo.com

Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web for japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the japanese tax law (tax useful life).

Taxes in Japan Filing Japanese Tax in Tokyo PLAZA HOMES

Depreciable Asset Tax Return Japan Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web for japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the japanese tax law (tax useful life). Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned.

From practicaljapan.com

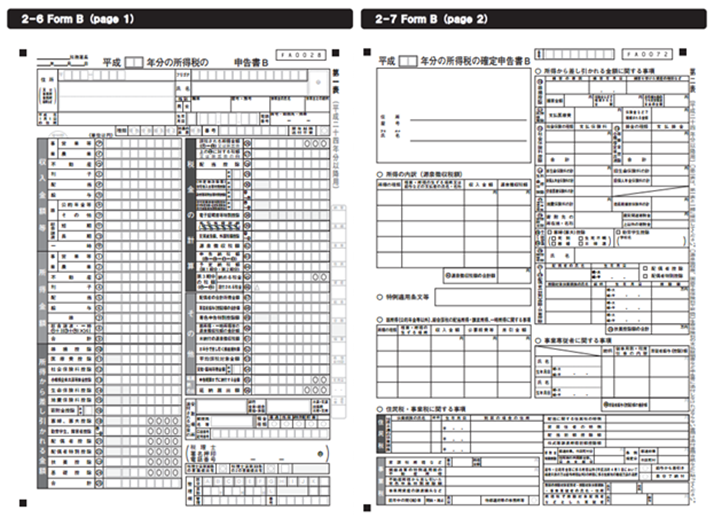

Kakuteishinkoku a simple guide to tax return in Japan Depreciable Asset Tax Return Japan Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web deadline for filing a tax return for the. Depreciable Asset Tax Return Japan.

From www.dreamstime.com

Tax Return in Japan. it is Written in Japanese Editorial Stock Image Depreciable Asset Tax Return Japan Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web depreciation property. Depreciable Asset Tax Return Japan.

From hsbjapan.com

How to Claim Your Tax Refund in Japan in 2022 HSB JAPAN Depreciable Asset Tax Return Japan Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation property tax is an asset that can be used for businesses. Depreciable Asset Tax Return Japan.

From www.dreamstime.com

Tax return in Japan stock image. Image of japanese, accounting 140332337 Depreciable Asset Tax Return Japan Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web land, structures, and depreciable assets for business use are subject to a fixed asset tax. Depreciable Asset Tax Return Japan.

From tokentax.co

Essential Guide to Crypto Tax in Japan for 2024 Depreciable Asset Tax Return Japan Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web land, structures, and depreciable. Depreciable Asset Tax Return Japan.

From mailmate.jp

How to File Your Final Tax Return in Japan MailMate Depreciable Asset Tax Return Japan Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation. Depreciable Asset Tax Return Japan.

From www.youtube.com

Japan Year End Tax Adjustment DEPENDENT Form 2015 YouTube Depreciable Asset Tax Return Japan Web for japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the japanese tax law (tax useful life). Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web deadline for filing. Depreciable Asset Tax Return Japan.

From tankenjapan.com

Taxes In Japan And How They Are Paid Depreciable Asset Tax Return Japan Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web for japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the japanese tax law (tax useful life). Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate. Depreciable Asset Tax Return Japan.

From tq-help.taxesforexpats.com

How to read Japanese Tax Statement (Gensen Choshu Hyo) TQ Help Depreciable Asset Tax Return Japan Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation property tax is an asset that can be used for businesses. Depreciable Asset Tax Return Japan.

From practicaljapan.com

Kakuteishinkoku a simple guide to tax return in Japan Depreciable Asset Tax Return Japan Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web depreciation under japan. Depreciable Asset Tax Return Japan.

From toma.co.jp

Qualified Invoice System Japan Tax Guide TOMAコンサルタンツグループ Depreciable Asset Tax Return Japan Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web depreciation. Depreciable Asset Tax Return Japan.

From www.best-of-sapporo-japan.com

Tax Return in Japan Depreciable Asset Tax Return Japan Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web deadline for filing a tax. Depreciable Asset Tax Return Japan.

From practicaljapan.com

Gensenchoshuhyou How to read Japanese withholding tax slip Practical Depreciable Asset Tax Return Japan Web for japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the japanese tax law (tax useful life). Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web land, structures, and depreciable assets for business use are subject to a fixed asset. Depreciable Asset Tax Return Japan.

From www.realestate-tokyo.com

Taxes in Japan Filing Japanese Tax in Tokyo PLAZA HOMES Depreciable Asset Tax Return Japan Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web deadline for filing a tax return for the business year containing the date on which a corporation in the public interest, etc. Web fixed assets that reduce in value in process of time such as buildings and vehicles are called depreciable. Web for japanese tax. Depreciable Asset Tax Return Japan.

From depositphotos.com

Tax Return Japan Written Japanese Tax Return Tax Office Stock Depreciable Asset Tax Return Japan Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web deadline for filing. Depreciable Asset Tax Return Japan.

From mailmate.jp

How to File Your Final Tax Return in Japan MailMate Depreciable Asset Tax Return Japan Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web for japanese tax purposes, fixed assets should be depreciated based on the useful life stipulated under the japanese tax law (tax useful life). Web deadline for filing a tax return for the business year containing. Depreciable Asset Tax Return Japan.

From www.realestate-tokyo.com

Property Taxes in Japan Explaining Fixed Asset Tax and City Planning Depreciable Asset Tax Return Japan Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web depreciation property tax is an asset that can be used for businesses other than land and houses that are owned. Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the. Depreciable Asset Tax Return Japan.

From japanconsult.com

Japan Consumption Tax System 2023 JMC Depreciable Asset Tax Return Japan Web land, structures, and depreciable assets for business use are subject to a fixed asset tax of 1.4%, payable by the owners of said. Web depreciation is deductible in the calculation of taxable income for corporation tax purposes. Web depreciation under japan corporate tax law november 2019 the calculation method for depreciation under japan corporate tax. Web for japanese tax. Depreciable Asset Tax Return Japan.